If you think maybe you have misplaced superannuation — and you will discover billions of pounds sitting down in missing or unclaimed superannuation accounts in accordance with the Australian Taxation Business — it is possible to seek out it here after which roll it in to the one particular fund.

Superannuation From a number of Views Employer an outlined profit superannuation materials a fixed, predetermined advantage according to several components, but It's not dependent on market place effectiveness.

Which means your employer need to shell out at the least 11.50% of your respective annual profits into your nominated super fund. While this is the least total they have to pay back, businesses can elect to spend a greater super fee than this as a corporation reward and also a way to appeal to and retain superior workers.

The fees that superannuation resources cost customers fluctuate greatly but are generally broken down into administration expenses and investment service fees.

Superannuation funds are already around the entrance-foot when it comes to ethical investing and many have supplied socially responsible expense selections for some a long time.

If an personnel wishes to withdraw superannuation at time of resignation, then all the amount of money is taxable.

you can find other types of contributions to Tremendous resources, which include authorities co-contributions for lower to middle-revenue earners and spouse contributions, which can provide tax benefits.

You can accessibility your superannuation any time you achieve your preservation age (in between fifty five and 60, based on any time you were born) and fulfill a affliction of launch, which include retiring with the workforce.

Ryan could be the founder and CEO at Tribeca economical, a economic assistance agency that listens, learns then gets you on course. He's an achieved economic advisor and financial wellbeing coach with over fifteen a long time of encounter.

Most importantly of all, superannuation is a thing that Australians have Command more than. one of many cornerstones of our retirement technique is our capability to opt for not only the fund, but also the sort of expense.

Your super fund's financial investment returns can significantly impression your retirement personal savings. It can be critical to know your chance profile and read more make sure your Tremendous is invested in a method that aligns with your retirement goals and hazard tolerance.

The ATO has a comparison tool which can assist you Evaluate the general performance of up to 4 super money but it is vital to take into consideration efficiency over the long term — not less than five years — as opposed to just 12 months.

What you'll observe is the fact each men and ladies are driving focus on In terms of achieving a comfortable retirement.

the leading issues to be familiar with about super involve the different types of Tremendous resources, the superannuation assure, how your hard earned money is invested And just how compounded investment decision returns function to benefit your equilibrium.

Patrick Renna Then & Now!

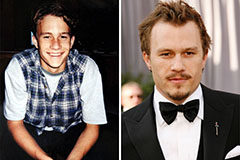

Patrick Renna Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!